In insurance sector, predictive analytics stands out as a game-changer. By leveraging the power of artificial intelligence (AI) and machine learning (ML), the industry is witnessing a revolutionary shift.

Insurance companies now utilize vast amounts of data to forecast events such as damage, fraud, and policy cancellations, thereby enhancing their decision-making capabilities and boosting overall business efficiency.

The Advantages of Predictive Analytics in the Insurance Sector

Predictive analytics offers a myriad of benefits that extend beyond traditional actuarial models. Its implementation leads to enhanced profitability, improved operational efficiency, and superior customer service. A study by Willis Towers Watson Life highlights the tangible outcomes: life insurance firms that have embraced predictive analytics report notable decreases in operational costs and significant sales growth.

Key Drivers and Beneficial Outcomes

The adoption of predictive analytics in the insurance industry is propelled by competitive pricing, earnings growth, technological advancements, and enhanced customer relationship management. Studies show that more than 80% of European insurers using predictive analytics report positive impacts on their operations, notably in expense reduction, sales increase, and profitability enhancement.

Applications in Property and Casualty Insurance

In the realm of property and casualty insurance, predictive analytics harnesses diverse data sets to forecast customer behavior and market trends. This intelligence is crucial for detecting fraudulent claims, assessing risk accurately, and implementing effective customer retention strategies. The result is a more streamlined claims management process and optimized operational performance.

Enhancing Cross-Selling Strategies and Customer Satisfaction

Predictive analytics is a powerful tool for identifying potential cross-selling opportunities, thereby boosting sales efficiency and customer satisfaction. By analyzing historical sales data and customer behavior, insurers can design targeted cross-selling initiatives, enhancing sales conversion rates and enriching the customer experience.

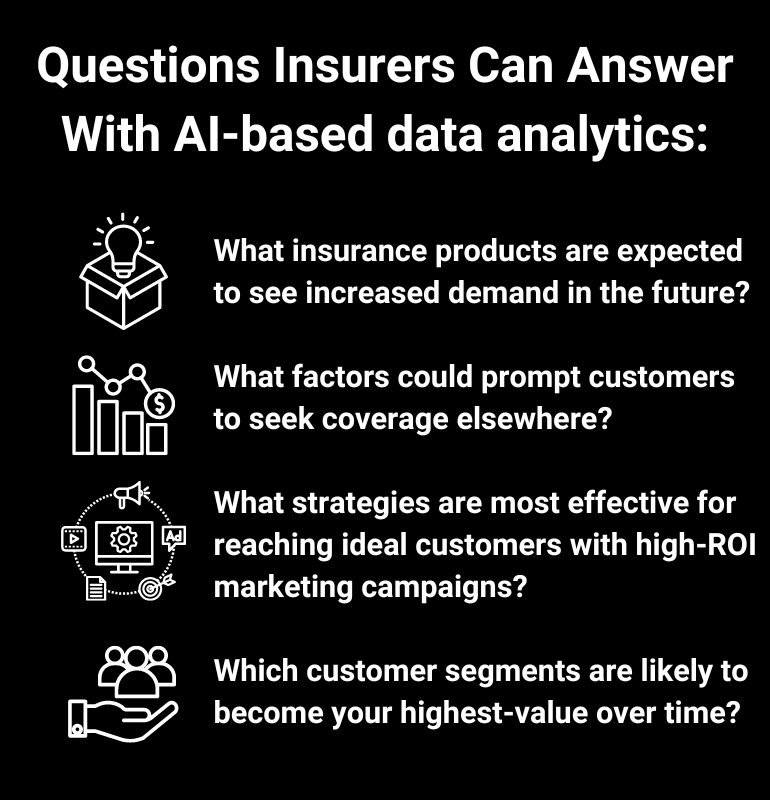

Proactive Customer Engagement through Predictive Analytics

With predictive analytics, insurance companies are better equipped to anticipate and fulfill the future needs of their customers through personalized offerings. This proactive approach significantly improves customer engagement and loyalty. Moreover, predictive analytics plays a crucial role in optimizing marketing efforts, minimizing customer attrition, and attracting new clientele, giving insurers a substantial advantage in a competitive market.

Conclusion

The adoption of predictive analytics in the insurance industry signifies a monumental shift towards data-driven decision-making and operational optimization. Insurance companies are now better positioned to deliver unparalleled customer experiences and achieve sustainable growth. As the industry continues to evolve, predictive analytics will undoubtedly remain a critical component of its success.

Discover the Power of Predictive Analytics with NextBrain AI

At NextBrain AI, we offer a comprehensive platform that harnesses the potential of generative AI for efficient data management. Our solutions facilitate data importation, cleansing, analysis, visualization, and generate insightful predictive analytics. Experience the transformative impact of NextBrain AI on your insurance operations. Schedule a demo today and embark on a journey to operational excellence.

+34 910 054 348

+34 910 054 348 +44 (0) 7903 493 317

+44 (0) 7903 493 317