La sensibilidad al precio es crítica para las empresas que desean aumentar las ventas y la retención de clientes. La sensibilidad al precio describe cuán sensibles son los consumidores a los cambios en el precio de un producto o servicio. Es necesario para determinar cuán bien funcionan tus estrategias de ventas y tiene un gran impacto en el comportamiento del cliente. En este artículo del blog, discutiremos la sensibilidad al precio, su importancia en las ventas, cómo medirla y más.

¿Qué es la sensibilidad al precio?

La sensibilidad al precio, que a menudo se denomina elasticidad precio de la demanda, cuantifica la medida en que la cantidad requerida de un producto o servicio cambia en reacción a un cambio de precio. En términos simples, mide el grado en que los consumidores son sensibles a las fluctuaciones de precios. Los clientes con alta sensibilidad al precio son más propensos a cambiar de opinión sobre qué comprar en respuesta a cambios de precio, mientras que aquellos con baja sensibilidad al precio son menos propensos a hacerlo. Analizar la sensibilidad al precio es crucial para poder tomar una serie de decisiones estratégicas:

- Optimización de Estrategias de Precios: Entender la sensibilidad al precio permite a las empresas ajustar sus estrategias de precios. Este conocimiento te permite establecer precios que resuenen con tu público objetivo, asegurando que perciban el valor de tu producto o servicio.

- Maximizar los ingresos: Al medir con precisión la sensibilidad al precio, las empresas pueden identificar el punto de precio óptimo que equilibra la satisfacción del cliente y la generación de ingresos. Esto ayuda a maximizar las ganancias y lograr un crecimiento sostenible.

- Posicionamiento Competitivo: El análisis de sensibilidad al precio te ayuda a mantenerte competitivo en el mercado. Saber cómo los cambios de precio afectan el comportamiento del cliente te permite posicionar tus ofertas de manera efectiva frente a los competidores, asegurando que tus precios se alineen con el valor percibido.

- Promoción y Descuentos: Entender la sensibilidad al precio es crucial al implementar promociones o descuentos. Ayuda a las empresas a determinar las promociones de precios más efectivas que impulsan las ventas sin comprometer la rentabilidad.

Calculando la Sensibilidad al Precio:

La sensibilidad al precio se puede calcular utilizando la fórmula:

Esta fórmula cuantifica la sensibilidad de la cantidad demandada a los cambios en el precio. Cuando el valor es alto (más de 1), significa que precios de venta más altos conducen a mayores cantidades vendidas. Además, podría ser el caso de que una disminución en el precio de venta resulte en una disminución en la cantidad vendida. Los ratios de sensibilidad positivos se consideran una anomalía para la teoría económica, ya que implican situaciones que tienen poco sentido y generalmente son causadas por una mala calidad de los datos. Los modelos económicos se centran principalmente en los valores negativos de sensibilidad. Los valores inferiores a uno indican que un aumento en los precios de venta resultará en una disminución en la cantidad vendida. Este escenario es el más interesante porque nos muestra cuán sensibles son los consumidores a los cambios de precio.

Las formas en que NextBrain.ai te ayudará a modelar la sensibilidad al precio.

NB te ayudará a realizar este análisis de varias maneras. Primero, cargaremos nuestros datos en la herramienta en línea, que incluye las unidades vendidas a lo largo del tiempo y los precios de venta de todos los productos que queremos analizar.

Esta fórmula cuantifica la sensibilidad de la cantidad demandada a los cambios en el precio. Cuando el valor es alto (más de 1), significa que precios de venta más altos conducen a mayores cantidades vendidas. Además, podría darse el caso de que una disminución en el precio de venta resulte en una disminución de la cantidad vendida. Los ratios de sensibilidad positivos se consideran una anomalía para la teoría económica, ya que implican situaciones que tienen poco sentido y son típicamente causadas por una mala calidad de los datos. Los modelos económicos se centran principalmente en los valores negativos de la sensibilidad. Los valores inferiores a uno indican que un aumento en los precios de venta resultará en una disminución de la cantidad vendida. Este escenario es el más interesante porque nos muestra cuán sensibles son los consumidores a los cambios de precios.

Las formas en que NextBrain.ai te ayudará a modelar la sensibilidad al precio.

NB te ayudará a realizar este análisis de varias maneras. Primero, cargaremos nuestros datos en la herramienta en línea, que incluye las unidades vendidas a lo largo del tiempo y los precios de venta de todos los productos que queremos analizar.

La forma más sencilla es interactuar con los datos a través de mensajes en el chat de Nextbrain.ai. Puedes pedirle a NB directamente que calcule el valor de la sensibilidad del precio para cada producto. El valor obtenido será el promedio de la sensibilidad de todos los datos recopilados.

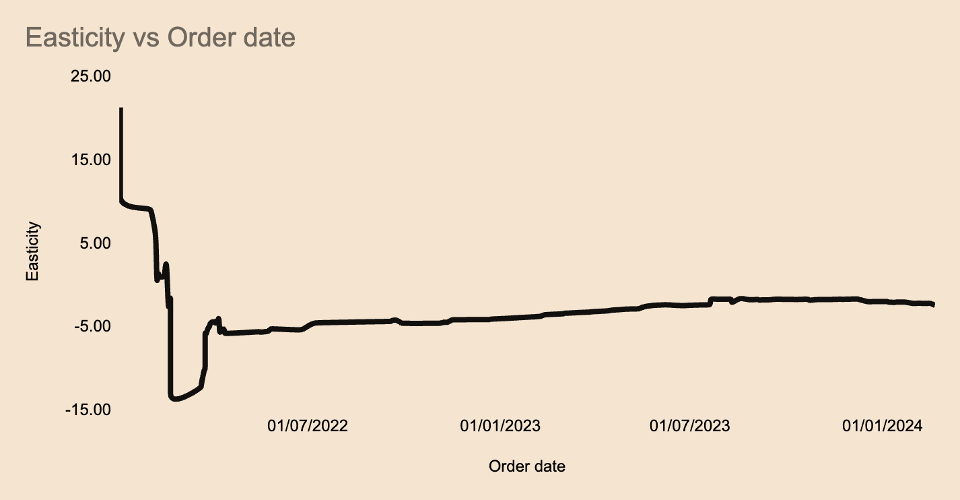

También es posible construir un modelo más detallado que te permita verificar la sensibilidad en función de los valores de precio y cantidad. La sensibilidad a menudo no es un parámetro lineal a lo largo del tiempo ni constante en todos los rangos de precios. Podemos ver, por ejemplo, si existe un umbral de precio más allá del cual la elasticidad cambia, o si hay un momento determinado a partir del cual la sensibilidad del producto experimenta un cambio significativo.

Con un análisis más detallado, podemos ver que los precios más bajos corresponden a mayores cantidades vendidas y viceversa. Sin embargo, también vemos que esta relación no es lineal en todo el rango de precios. Esto podría corresponder, por ejemplo, a diversas estrategias de precios a lo largo del periodo de datos o a efectos de estacionalidad. Finalmente, queremos tener un valor promedio o de referencia para evaluar la sensibilidad al precio de un producto.

Si observamos el valor promedio de esta sensibilidad a lo largo del tiempo, podemos ver que fluctúa considerablemente al principio y gradualmente se vuelve estable. Este valor final es el que utilizaremos para definir nuestra estrategia de precios para el futuro.

Conclusiones

En el dinámico panorama de las ventas, comprender la sensibilidad al precio es un factor determinante. Permite a las empresas tomar decisiones informadas sobre estrategias de precios, promociones y posicionamiento en el mercado. Al reconocer y aprovechar la sensibilidad al precio, las empresas pueden crear una estructura de precios que no solo atraiga a los clientes, sino que también mejore la rentabilidad en general.

+34 910 054 348

+34 910 054 348 +44 (0) 7903 493 317

+44 (0) 7903 493 317